|

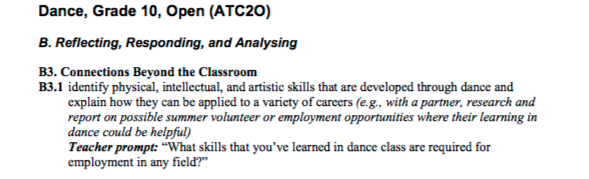

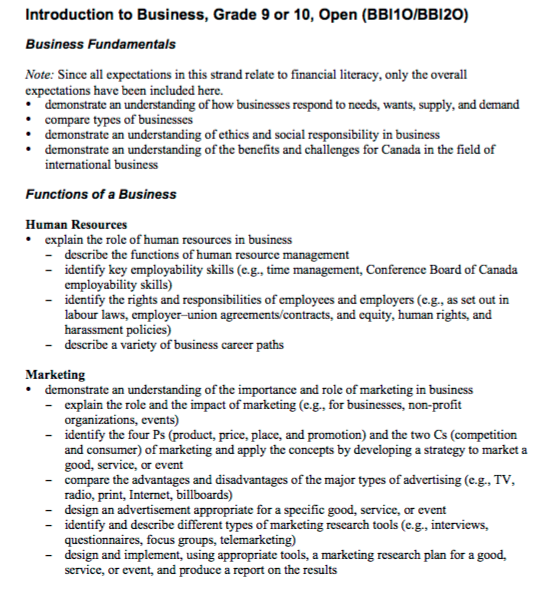

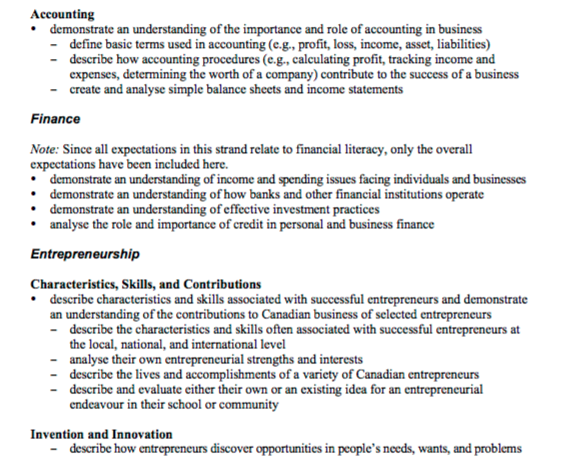

November is Financial Literacy month in Canada and this seems to be the perfect time for me to reflect on my Province's approach to financial literacy education. With a simple, one-word response, I believe Ontario's approach to teaching kids about money sense is weak, at best. The Ontario Ministry of Education does not believe financial literacy should be taught in a specific and clearly defined manner - i.e. a dedicated financial course that all secondary school students should take prior to graduation, for example. These folks believe that an integrated approach across the curriculum works best. Well, my belief is that it doesn't, and I am going to tell you why. Here is the Ministry's directive regarding the teaching of financial literacy in Ontario schools: Source: http://www.edu.gov.on.ca/eng/surveyLiteracy.html Please note that I am a secondary teacher and my point of view, and overall arguments here are from a 9-12 teaching perspective. Although I appreciate the Ministry's sentiment that financial literacy is important, the process of attempting to incorporate these learning opportunities across the 9-12 curriculum does not make much sense to me, and frankly, it just doesn't happen. The Ministry has published a document called Financial Literacy: Scope and Sequence of expectations. The full document can be accessed here: http://www.edu.gov.on.ca/eng/document/policy/FinLitGr9to12.pdf The document suggests that teachers can use the identified course expectations to incorporate elements of financial literacy into their courses and lesson plans. I don't believe this ever happens. Let me illustrate with an example: The document indicates, for example, that a Dance teacher can incorporate financial literacy into their courses. In the ATC2O (Grade 10 Dance) course specifically, the document suggests the teacher could successfully incorporate some element of financial literacy here: I struggle to sort in my mind how and what element of financial literacy the Dance teacher is going to be teaching here? Can someone help me out? The document also does not identify what element of financial literacy might be incorporate here. Is this for the Dance teacher to randomly decide? Do they have the education, experience, and knowledge of financial literacy to effectively do this? I would bet a large sum of money on the notion that there are very few Dance teachers incorporating RRSP or RESP discussions into their Dance lessons. So, if the Dance teacher isn't doing this, what teachers are? Is it the Music teacher? The Physical Education teacher? The Science teacher? The Canadian History teacher? The subject discipline with the highest level of learning goals/course expectations that are specific to financial literacy is Business Studies. By the simple nature of Business Studies course content, financial literacy is already taught in many grade 9-12 Business Studies courses. One course with a very high number of expectations already directly related to financial literacy is BBI1O/2O - Introduction to Business. Just look at all the financial literacy related learning opportunities that exist in this course: The only problem...wait for it...here it is....Business Studies IS NOT A MANDATORY SUBJECT in order to achieve the Ontario Secondary School Diploma! That is right, an Ontario student can graduate secondary school without ever taking a business studies credit...it makes me weep! So, only students who have elected to take business studies credits, and BBI1O/2O specifically, will have this deeper exposure to real financial literacy learning.

I have one simple solution - make business studies mandatory. If every student in Ontario was required to take BBI1O/2O, they would be better equipped to go on and become financially literate adults. I hear that the Ministry has decided to review the 1/2 credit Careers course, add elements of financial literacy, and make it a full credit mandatory course. My concerns/suggestions:

We owe it to the next generation to teach them about business. Will I see a Business Studies credit a mandatory graduation requirement before I retire from this great profession (that's 2030 by the way)? I really hope so.

3 Comments

|

John GrahamA Secondary School eLearning Business Studies Teacher in Muskoka, Ontario, Canada. Archives

February 2020

Categories |

RSS Feed

RSS Feed